Do You Need an LLC for Vending Machines Business? Cost & Benefit

A lot of people are interested in expanding their passive income by starting a vending machine business.

However, most people don’t know much about the necessary paperwork to start one, or whether they’re required to apply for one in the first place.

So, do you need an LLC for vending machines?

Technically, No you don’t need an LLC to start your vending machine business. However, it’s highly recommended that you set an LLC up to protect yourself from getting taxed twice and focus on growing your business, especially since setting one up is easy and affordable.

In this guide, we’ll show you all the necessary information about the LLC application for vending machines and their benefits.

Let’s dive in!

RELATED READ:

- Vending Machine License in Australia: Criteria & Requirements

- How Much Does a Vending Machine Cost in Australia?

What Exactly is an LLC?

First, you need to understand what an LLC is and what it means to a business in order to judge whether it’s suitable for your vending machine business.

LLC is short for a “Limited Liability Company”, which is one of the most popular business structures in the United States and is very common among small businesses. As the name suggests, this structure provides any business with limited liability benefits.

In other words, when you create an LLC, it becomes a legal entity that has the right to own and run any business. If your vending machine business is run by an LLC, your personal assets will be protected in the case of lawsuits or defaulting on debt by creditors.

This means that LLC grants your business the benefits of a corporation but without the deep complications and the heavy costs and formalities of running one.

Is an LLC Necessary for Operating a Vending Machine Business?

One thing you need to know about LLC status is that it’s not mandatory. Technically, you don’t have to set up an LLC in order to operate a vending machine business.

However, just because it’s not mandatory, doesn’t mean you shouldn’t. In fact, it’s highly recommended that you set an LLC up because its benefits are vast, especially if you’re concerned about your personal assets.

You see, LLC might come with a little paperwork and hassle as well as costs. However, the benefits you get from setting it up far overshadow them all, but more about these benefits in the following section.

What Are the Benefits of an LLC?

Now that you know that an LLC is not mandatory, you might be wondering why we recommend that you set one up if you have a vending machine business, and for that reason, let’s have a quick look at the benefits that you get from setting up your own limited liability company

As previously mentioned, one of the major reasons why a lot of small business owners, such as vending machine businesses, set up an LLC is to grant its protective status.

Since your business will be owned by an LLC, all the personal assets registered to your name will be protected in case your business is sued or you default on a debt, such as your house, vehicles, etc.

However, you don’t need to worry about increased taxes because the profits from your business will be considered the company’s money and passed through to the owner as personal income. This means that you won’t have to be taxed twice for the same income.

In addition to protection and taxation benefits, having your vending machine business under the umbrella of a limited liability company adds a layer of professionalism and credibility when dealing with banks, distributors, and other businesses.

Many banks offer more flexible policies while lending or financing LLC businesses rather than sole proprietorships.

How Much Does it Cost to Set Up an LLC for Vending Machine Business?

A lot of vending machine owners are concerned about the costs of setting up an LLC. Luckily, the LLC is a relatively small fee that you pay to the state where your business is located, although some states may charge an annual or biennial fee at a much lower cost.

One thing you need to know here is that the costs of an LLC will vary from one state to another. The cost of an LLC will vary from as low as $40 (Kentucky) and as high as $500 (Massachusetts), with the average cost among all states around $132.

As you can see, this is a relatively small fee when compared to the benefits it can grant you, so you can write it off as an investment expenses

How to Apply for an LLC for Your Vending Machine Business?

Now that you know more about the benefits of setting up your own LLC for your vending machine business, you might be wondering how to do it. In this section, we’ll walk you through a quick guide to getting the job done:

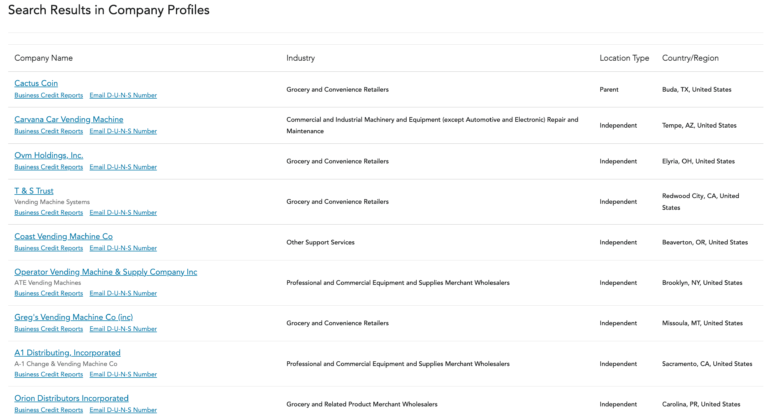

- Start by checking your state to find out the fees required in your state. You can do this by checking this website.

- Next, you’ll need to come up with a unique name for your LLC and check its availability.

- Register your DBA (this is also known as “business name”, and unlike LLC, this one is a requirement to run a business, including vending machine business)

- File your LLC documents (also known as articles of organization or certificate of formation) with your state.

- Designate a registered agent for communications with the government, if you’re the only person running your business, this would be you.

- Fulfill all requirements for publication depending on your state and pay the fees for the registry

- Open a bank account for your limited liability company.

Final Thoughts

This wraps it up for today’s guide that walks you through everything you need to know about LLCs for vending machines.

As you can see, applying for an LLC status isn’t mandatory. However, if you want to start a vending machine business, the benefits of applying for one make it well worth the hassle and extra costs!

In the end, always make sure that you consult a legal expert or inquire about any special licensing or paperwork that you need to fulfill before running a vending machine business in your area.